However to deduct employee business expenses your total miscellaneous deductions must be more than 2 of your Adjusted Gross Income. Tap the Workers menu to choose the Employees option.

What Does Per Diem Mean Definition Term Meaning Nurse Theory

To record the per diem lets create a payroll item and then add the amount to the paycheck.

. OUTSIDE CONUS Non-Foreign Overseas and Foreign. We believe its better for healthcare organizations and clinicians interested in flexible work to connect directly and transparently - without an agency or agency profits in the middle. 02282022 View summary of changes.

INCLUDE ALL CITIES AND TOWNS INCLUDE MILITARY INSTALLATIONS. IRS Publication 547. A document published by the Internal Revenue Service IRS that provides information on how taxpayers are to treat casualty theft and other property gains and losses when.

To offset this income you may report your actual expenses as Job-Related itemized deductions. We like to break the rules. I can share some information about adding this per diem in QuickBooks Online QBO.

Whether youre a clinician or a partner the power is in your hands. Carpe diem especially those receipts. That doesnt mean that as the go-to person youre required to be the constant well of resourceful information and all around direction-pointer eventually the well runs out of water.

The requirement to provide coverage is based on current full-time status and length of employment not full-time status at time of hiring. What exactly does Un-Agency mean. This does not mean all will succeed equally or that there will be total uniformity.

Per diem is a Latin term that translates to per day or by the day From a business perspective you need to know about two different per diem scenarios. Once a full-time employee is in a stability. 05022022 View summary of.

It does mean that all will have an opportunity to succeed and. What does per diem meanand how does it relate to small businesses. Welcome to the Online Community.

That doesnt mean that you should be a constant crutch for other clueless employees or someone looking for an easy out on work while taking all the credit. Per diem employees and per diem travel expenses. Travel and Transportation Rates Per Diem Rates Per Diem Rates Query Per Diem Rates Query.

Yes if your per diem payments were reported to you on Form 1099 you will include this income on your tax return. When using a timesheet you can only track the service worked on a customerjob. There are many benefits to per diem work but it works best for those who prefer flexibility and work well with finances and budgeting.

If an employee switches to part-time they no longer have to be offered coverage starting on a specific date that specific date depends on complex factors related to measurement periods. Understanding what per diem means in a business context can get confusing whether you prefer a per diem work lifestyle or want to know more about per diem allowances.

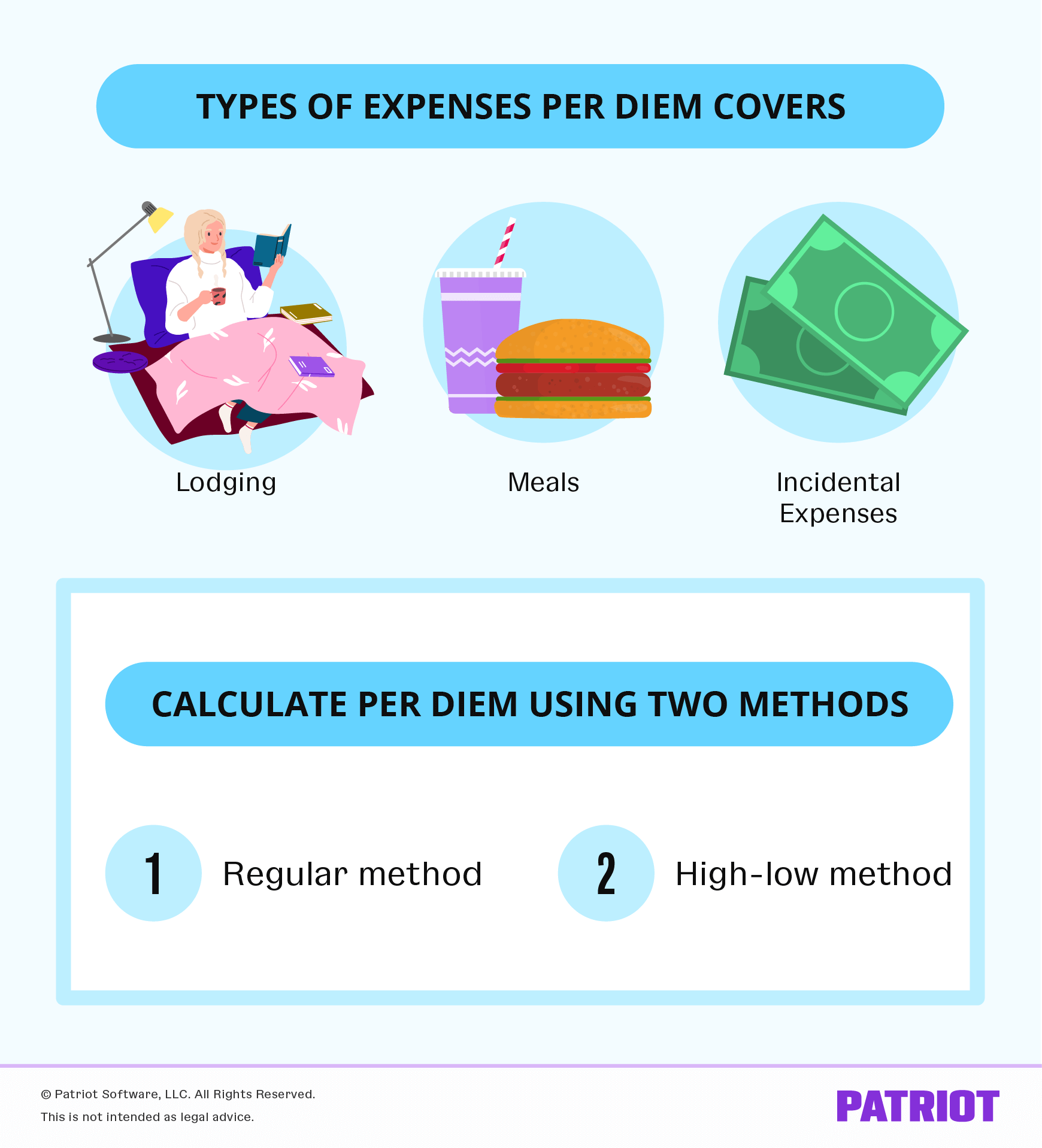

What Is Per Diem Definition Types Of Expenses More